Trump Plans 10% Tariffs on Chinese Imports: What It Means for Trade, Economy, and Global Relations

Key Points:

- Implementation Date: A 10% tariff on Chinese imports will take effect on February 1, 2025.

- Reason for Tariffs: President Trump attributes the decision to China’s alleged role in the U.S. fentanyl crisis, citing its export to neighboring countries as a key factor.

- Historical Context: This policy follows Trump’s earlier tariff impositions during his presidency, aiming to counter perceived trade imbalances and exert pressure on China.

- Economic Repercussions: Analysts fear potential retaliation from China, leading to inflation and disruptions in American industries.

- Global Reactions: China’s government warns of consequences and emphasizes its resolve to protect national interests, while public opinion in China remains divided.

Why Is the U.S. Imposing 10% Tariffs on Chinese Imports?

President Donald Trump’s announcement of a 10% tariff on Chinese imports, effective February 1, 2025, underscores a significant shift in U.S.-China trade relations. This move is tied to the administration’s broader strategy to counteract the opioid epidemic, with Trump blaming China for exporting fentanyl to Mexico and Canada, from where it enters the U.S. illegally. During a White House press briefing, Trump stated, “China’s actions directly harm the American people, and we will use every tool at our disposal to ensure accountability.”

How Do These Tariffs Fit into Trump’s Trade Policy?

The new tariffs reflect a continuation of Trump’s first-term trade policies, which included imposing tariffs on billions of dollars’ worth of Chinese goods. By targeting China’s exports, the U.S. aims to reduce its trade deficit while pressuring Beijing to address concerns over intellectual property theft, unfair trade practices, and now, its alleged role in the fentanyl crisis.

This policy is part of a broader framework that has also seen Trump propose a 25% duty on imports from Canada and Mexico, citing concerns over drug trafficking and immigration. The administration’s strategy seems aimed at leveraging trade policy as a tool for addressing both economic and domestic security issues.

What Are the Economic Risks of Trump’s Tariff Plan?

While the administration views tariffs as a mechanism to safeguard American interests, economists warn of significant risks:

- Retaliation from China: Beijing has historically responded to U.S. tariffs with its own countermeasures, targeting American industries such as agriculture and technology. Retaliatory tariffs could hurt American exporters, particularly farmers, who rely on the Chinese market.

- Inflationary Pressures: Tariffs often increase the cost of imported goods, leading to higher prices for consumers. In an already fragile economy, these additional costs could exacerbate inflation and strain household budgets.

- Industry Disruptions: Sectors reliant on Chinese imports, including manufacturing and retail, may face supply chain disruptions and increased production costs, potentially impacting jobs and profitability.

How Has China Reacted to the Announcement?

China’s initial response has been firm. In a statement, a spokesperson for the Chinese Ministry of Commerce said, “Trade wars have no winners, and the U.S. will face consequences if it continues to escalate tensions.” The Chinese government has also reiterated its commitment to defending its national interests and protecting its economic stability.

On Chinese social media platforms, reactions have been mixed. Some users criticized the U.S. for its unpredictable policies, while others expressed concerns about how the tariffs might impact small businesses dependent on American markets.

Historical Context: Trump’s Tariff Strategy Revisited

The imposition of tariffs is not new territory for President Trump. During his first term, he levied duties on Chinese goods worth over $360 billion, sparking a trade war that disrupted global markets. While these measures were intended to compel China to address U.S. grievances, they also led to economic challenges domestically, including higher costs for American consumers and industries.

This new round of tariffs builds on that legacy but introduces a novel justification: addressing the fentanyl crisis. Critics argue that this approach conflates trade policy with law enforcement issues, risking unintended consequences in both arenas.

What Are the Broader Implications for Global Trade?

The new tariffs could have ripple effects beyond the U.S. and China. If Beijing retaliates, other nations might find themselves caught in the crossfire, particularly those with strong trade ties to both countries. Additionally, global supply chains could face further disruptions, compounding challenges already exacerbated by the pandemic and geopolitical conflicts.

Public and Political Reactions in the U.S.

Domestically, Trump’s announcement has sparked debate. Supporters view the tariffs as a necessary step to protect American interests and address the fentanyl crisis. Critics, however, warn that the approach could backfire, leading to economic pain without effectively addressing drug trafficking.

Democratic leaders have expressed skepticism about the strategy, questioning its focus and potential effectiveness. Meanwhile, trade associations representing affected industries have voiced concerns about the impact on businesses and consumers.

What Could Happen Next?

As February 1 approaches, several scenarios are possible:

- Negotiations: China and the U.S. could engage in last-minute talks to avert escalation. However, the likelihood of a comprehensive agreement appears slim given the entrenched tensions.

- Retaliatory Measures: If China imposes its own tariffs, the U.S. may respond with additional measures, potentially escalating the conflict further.

- Economic Adjustments: Businesses may begin altering supply chains to minimize exposure to tariffs, accelerating a shift away from China as a manufacturing hub.

Frequently Searched Questions Answered

What are Trump’s reasons for imposing tariffs on Chinese imports?

President Trump cites China’s alleged role in the U.S. fentanyl crisis as the primary reason for the tariffs. He accuses China of exporting fentanyl precursors to neighboring countries, from where they enter the U.S., exacerbating the opioid epidemic.

How will the 10% tariffs impact American consumers?

The tariffs are likely to increase the cost of goods imported from China, including electronics, clothing, and household items, potentially leading to higher prices for consumers.

Could these tariffs lead to a trade war?

Yes, there is a significant risk of escalation. If China retaliates with its own tariffs, it could trigger a cycle of measures and countermeasures, reminiscent of the U.S.-China trade war during Trump’s first term.

What industries will be most affected by the tariffs?

Industries heavily reliant on Chinese imports, such as technology, manufacturing, and retail, will face increased costs. Agricultural sectors could also be affected if China targets U.S. exports in response.

When will the tariffs take effect?

The 10% tariffs on Chinese imports are scheduled to take effect on February 1, 2025.

Conclusion: Balancing Trade Policy and Domestic Concerns

Trump’s 10% tariffs on Chinese imports mark a bold move in addressing both trade imbalances and the opioid epidemic. While the administration sees this as a dual-purpose strategy, the economic and geopolitical risks are considerable. As the situation unfolds, the world will watch closely to see whether this approach achieves its intended goals or exacerbates existing challenges.

Image Credit: https://www.ft.com/

Sources and References

Latest Posts

- Dan Bongino’s Unprecedented Rise: A New Chapter for the FBI?

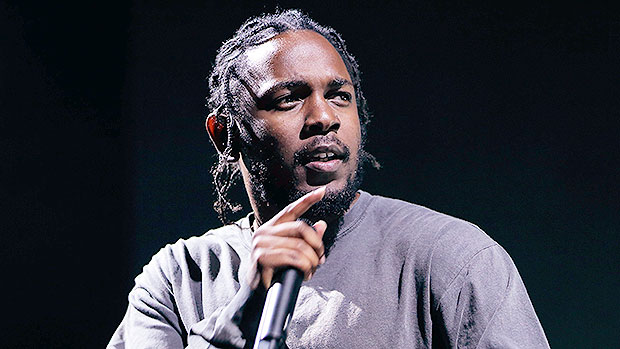

- kendrick lamar: How a Super Bowl Halftime Show Revolutionized Music Streaming

- Philadelphia Eagles Clinch Second Super Bowl Title with a Commanding 40-22 Victory in Super Bowl 2025

- 4 Must-Read Business Books for Entrepreneurs

- Everything You Need to Know About Silo Season 3: Release, Cast, and Plot Insights

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.